Principles of Lending

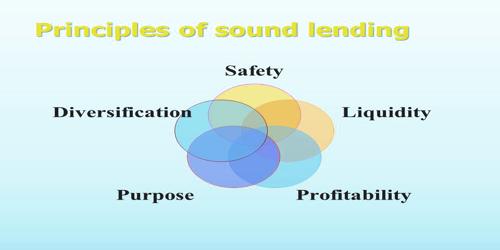

The process of lending money involves more than just giving funds and expecting them back with interest. For banks and financial institutions, lending must be done responsibly, securely, and profitably. This is where the time-tested Principles of Lending come into play. These principles serve as a guiding framework to ensure that loans are safe, productive, and serve the broader goals of the economy.

1. Safety of Funds

The primary concern of any lender is whether the borrower will repay the loan. Safety does not mean avoiding risk completely, but it means lending to those who are creditworthy, with a proven ability and willingness to repay.

- Lenders assess income stability, past credit behavior, and repayment history.

- Collateral or guarantees often enhance the sense of safety.

2. Liquidity

Lenders prefer loans that will be repaid in time and generate cash flows. The liquidity principle ensures that the repayment schedule matches the borrower's cash-generating ability and the bank’s own funding strategy.

- Short-term loans for working capital are expected to be repaid within 12 months.

- Longer-term loans (e.g. home loans) have structured EMIs to maintain liquidity.

3. Purpose of Loan

Banks lend for productive and legal purposes. The use of borrowed funds must lead to income generation, asset creation, or societal value — not speculation or gambling.

- Home loans, education loans, MSME loans — all have defined purposes.

- Personal loans must also be for clear, legitimate reasons.

4. Profitability

Banks are commercial institutions. Lending must result in interest income, processing fees, or commissions. Loans with high risk but low return are generally avoided unless subsidized by government schemes.

- Interest rates depend on borrower risk, tenure, and market rates.

- Subsidized loans (like for farmers) are often supported by government compensation.

5. Security (Collateral)

To reduce credit risk, lenders often ask for security — an asset that can be claimed if the borrower defaults. This is especially important in large, long-term loans.

- Tangible: land, gold, property

- Intangible: guarantees, future receivables

- Security improves the lender's confidence but does not replace due diligence.

6. Diversification of Risk

Banks follow the principle of not putting all eggs in one basket. This means:

- Lending across industries (agriculture, retail, MSME, infrastructure)

- Lending across geographies

- Monitoring sectoral caps (e.g. no more than 20% of loans in real estate)

7. Creditworthiness of the Borrower

This is often considered the most critical factor. It includes:

- Character: Borrower's reputation and honesty

- Capacity: Ability to repay from future cash flows

- Capital: Own funds or equity in the project

- Collateral: Available security or assets

- Conditions: Economic and regulatory environment

This is known as the 5 Cs of Credit — used universally across all lending institutions.

8. National Interest

While lending is a business, banks also serve public policy objectives. They must lend to sectors that promote inclusive growth, development, and employment generation — even if profitability is lower.

- Loans to priority sectors (agriculture, small business, weaker sections)

- Support to government schemes like MUDRA, PMAY, or Stand-Up India

Conclusion:

Following the Principles of Lending helps financial institutions reduce defaults, improve profitability, and serve the larger goal of inclusive economic development. Whether lending ₹10,000 to a farmer or ₹10 crore to a business, these principles ensure responsible, thoughtful credit allocation.