Indian Financial System

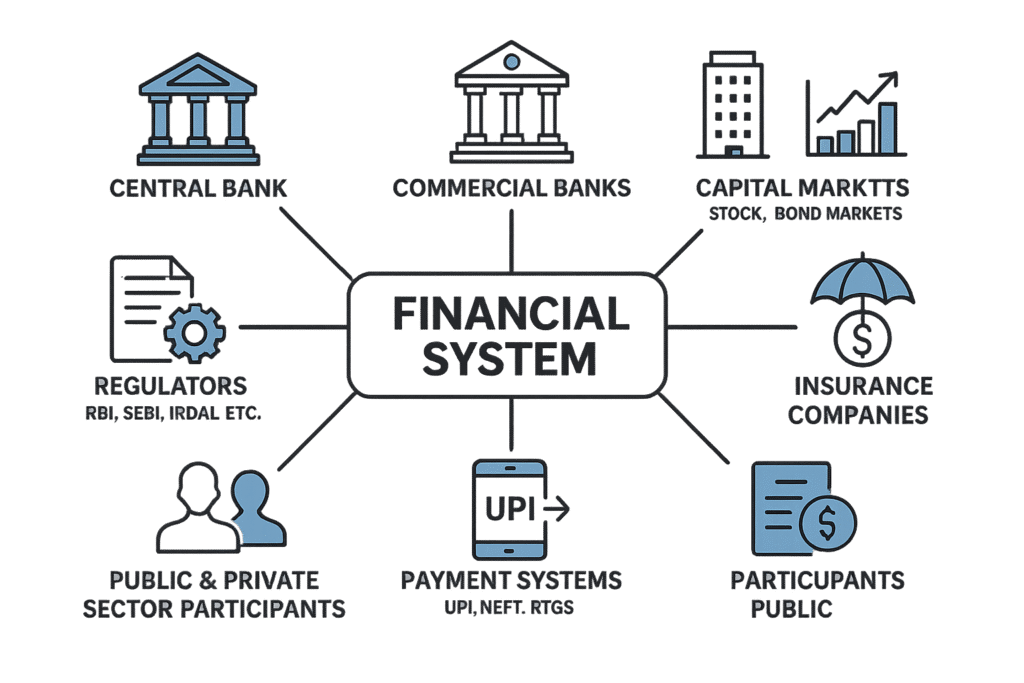

The Indian Financial System refers to a set of institutions, markets, instruments, services, and regulatory frameworks that facilitate financial transactions and promote economic growth. It plays a crucial role in mobilizing savings, allocating capital, managing risk, and enabling smooth payments in the economy.

Key Insight: A well-functioning financial system is the backbone of a nation's economic development.

Components of the System

- Financial Institutions – Intermediaries like banks and insurance companies

- Financial Markets – Platforms to trade securities like stocks and bonds

- Financial Instruments – Contracts like shares, debentures, and derivatives

- Financial Services – Banking, investment, insurance, and payment services

Financial Institutions

A. Regulatory Bodies

- RBI (Reserve Bank of India) – Regulates banks, monetary policy, payments, and forex

- SEBI – Securities and Exchange Board of India (regulates capital markets)

- IRDAI – Insurance Regulatory and Development Authority of India

- PFRDA – Pension Fund Regulatory and Development Authority

B. Intermediaries

- Commercial Banks: SBI, HDFC, ICICI

- Cooperative Banks: Regional rural and urban banks

- NBFCs: Bajaj Finance, HDB Financial, Muthoot

- Insurance Companies: LIC, ICICI Prudential

- Mutual Funds: HDFC AMC, SBI Mutual Fund

- Development Finance Institutions: NABARD, SIDBI, EXIM Bank

Financial Markets

Markets facilitate the raising and allocation of capital.

A. Money Market

- Short-term instruments: Treasury Bills, Certificates of Deposit

- Regulated by RBI

B. Capital Market

- Long-term funding: Equity shares, bonds, debentures

- Primary Market (IPOs) and Secondary Market (NSE, BSE)

C. Forex Market

- Currency exchange: USD/INR, EUR/INR, etc.

- Managed by RBI under FEMA

D. Derivatives Market

- Used for hedging risk via futures, options, swaps

- Regulated by SEBI

Financial Instruments

- Equity shares

- Debentures and Bonds

- Commercial Papers, Treasury Bills

- Mutual Fund Units

- Insurance Policies

- Derivatives: Options, Futures

Financial Services

- Retail & corporate banking

- Insurance & risk coverage

- Asset management and advisory

- Investment banking

- Digital payments (UPI, NEFT, RTGS)

- Merchant banking

Role of RBI

- Formulates and implements monetary policy

- Regulates and supervises banks and NBFCs

- Issues currency and manages inflation

- Regulates payments (e.g., UPI, IMPS, RTGS)

- Manages forex reserves and exchange rates

- Drives financial inclusion and innovation

Importance of the Financial System

- Mobilizes savings and directs them to productive sectors

- Encourages investment and entrepreneurship

- Promotes economic stability and growth

- Improves access to credit and insurance

- Drives technological advancement in fintech

Challenges

- High NPAs (Non-Performing Assets)

- Low rural penetration and financial literacy

- Cybersecurity and digital fraud risks

- Shadow banking risks in NBFCs

- Overlapping regulations

Recent Trends and Reforms

- Introduction of Digital Rupee (CBDC pilot)

- UPI transaction volume crossing ₹20 lakh crore/month

- Growth of neobanks and embedded finance

- Credit scoring using alternative data (like utility payments)

- Push for financial inclusion through JAM Trinity (Jan Dhan, Aadhaar, Mobile)

Conclusion

The Indian financial system is robust, diverse, and evolving rapidly. With the active role of regulators like the RBI and SEBI, and the rise of fintech innovation, India is building a globally competitive, inclusive, and technology-driven financial ecosystem.

Sources: RBI.org.in, SEBI.gov.in, Investopedia, Economic Times, Livemint