The Guide to Money Market Instruments

In the complex world of finance, the money market plays a quiet but powerful role in maintaining the liquidity and efficiency of the financial system. Whether you're an investor, banker, or student of finance, understanding how money market instruments work is crucial. These instruments help institutions manage short-term funding gaps, while offering investors a safe place to park surplus funds.

What is the Money Market?

The money market is a segment of the financial market that deals with short-term debt instruments — typically with maturities of one year or less. It is a wholesale market where large-volume transactions occur between institutions, banks, governments, and corporations. The key purpose of this market is to provide liquidity and efficient funding for short-term needs.

Importance of the Money Market

- Ensures short-term liquidity for the financial system

- Enables central banks like RBI to regulate money supply

- Allows corporations to meet working capital needs

- Offers safe, short-term investment options for institutions

- Acts as a barometer of short-term interest rates

Key Characteristics of Money Market Instruments

- Short maturity: Less than one year

- Low risk: Most are issued by highly rated institutions or governments

- High liquidity: Easily tradable in secondary markets

- No coupon: Issued at discount, redeemed at face value

- Large denominations: Typically used by institutions, not retail

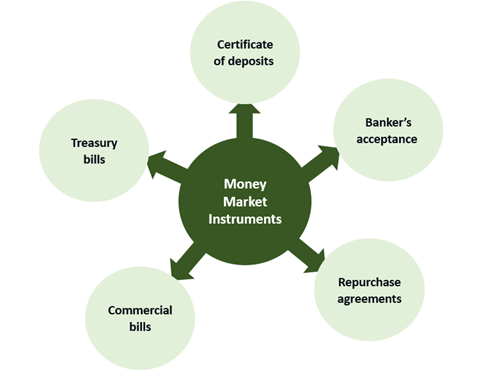

Types of Money Market Instruments in India

1. Treasury Bills (T-Bills)

Issued by the Government of India through the RBI, these are zero-coupon securities with maturities of 91, 182, and 364 days.

- Issued at a discount and redeemed at face value

- Backed by the government — virtually risk-free

- Used by banks and mutual funds for safe, liquid parking of funds

2. Commercial Paper (CP)

Commercial Paper is a short-term unsecured debt instrument issued by corporations with high credit ratings. It typically has a maturity of 7 days to 1 year.

- Issued at a discount; tradable in secondary markets

- Used to meet working capital and short-term liabilities

- Offers higher yield than T-Bills, but comes with credit risk

3. Certificate of Deposit (CD)

These are negotiable time deposits issued by scheduled commercial banks and select financial institutions.

- Tenure: 7 days to 1 year (for banks); 1 to 3 years (for financial institutions)

- Higher interest than savings accounts

- Issued in dematerialized form and traded in secondary markets

4. Call Money and Notice Money

Call money is borrowed for 1 day; notice money ranges from 2 to 14 days. This segment allows banks to manage daily fund requirements.

- Unsecured and interbank in nature

- Rates fluctuate daily based on liquidity

- Vital for RBI’s liquidity adjustment facility (LAF)

5. Repurchase Agreements (Repo & Reverse Repo)

A repurchase agreement (repo) involves selling securities with an agreement to repurchase them later. It’s a short-term borrowing tool used by banks and RBI to manage liquidity.

- Repo: Borrower sells securities and agrees to repurchase

- Reverse Repo: Lender purchases securities and agrees to sell back

- Collateralized — usually backed by government securities

6. Banker’s Acceptance (BA)

A Banker’s Acceptance is a time draft guaranteed by a commercial bank, used primarily in international trade to guarantee payment.

- Traded at a discount in the secondary market

- Not commonly used in India but prevalent in global trade

Participants in the Indian Money Market

- Commercial banks

- RBI

- Mutual funds

- Non-banking financial companies (NBFCs)

- Corporate treasuries

- Primary dealers and insurance companies

Money Market Mutual Funds (MMMFs)

Retail investors can access the money market through MMMFs. These mutual funds invest in T-Bills, CPs, CDs, repos, and other instruments with maturities under 1 year.

- Highly liquid and low volatility

- Offer better returns than traditional savings accounts

- Ideal for parking funds for 3 to 12 months

Benefits of Money Market Instruments

- Capital Safety: Instruments like T-Bills are virtually risk-free

- Quick Liquidity: Easily tradable and redeemable

- Predictable Returns: Fixed maturity and known discount price

- Diversification: Allows institutions to spread cash exposure

- Efficient Cash Management: Widely used by corporates and banks

Risks & Limitations

- Credit Risk: Applies to CPs and some CDs

- Low Returns: Less rewarding than equity or long-term debt

- Not Always Accessible to Retail Investors: Due to large denominations

- Interest Rate Risk: Prices fluctuate with monetary policy changes

Regulators of Money Market in India

The money market in India is regulated and supervised by multiple agencies:

- Reserve Bank of India (RBI): Regulates call money, repo, T-Bills

- SEBI: Regulates money market mutual funds

- FIMMDA: Provides benchmarks and guidelines for trading

Real-World Applications

- Banks: Manage short-term liquidity and SLR/CRR needs

- Corporates: Meet payrolls or vendor payments

- Governments: Bridge fiscal gaps through T-Bills

- Investors: Park idle funds without equity risk

Final Thoughts

Money market instruments may not grab headlines like stocks or crypto, but they are the bedrock of financial stability. For retail investors, they offer safety and liquidity. For institutions, they offer flexibility. For policymakers, they are tools of economic control. Whether you're an investor or finance student, understanding the money market is foundational to mastering capital markets.

📩 Want more content like this? Subscribe to Smart Niveshak — your weekly source for bite-sized investing insights, tools, and explainers.