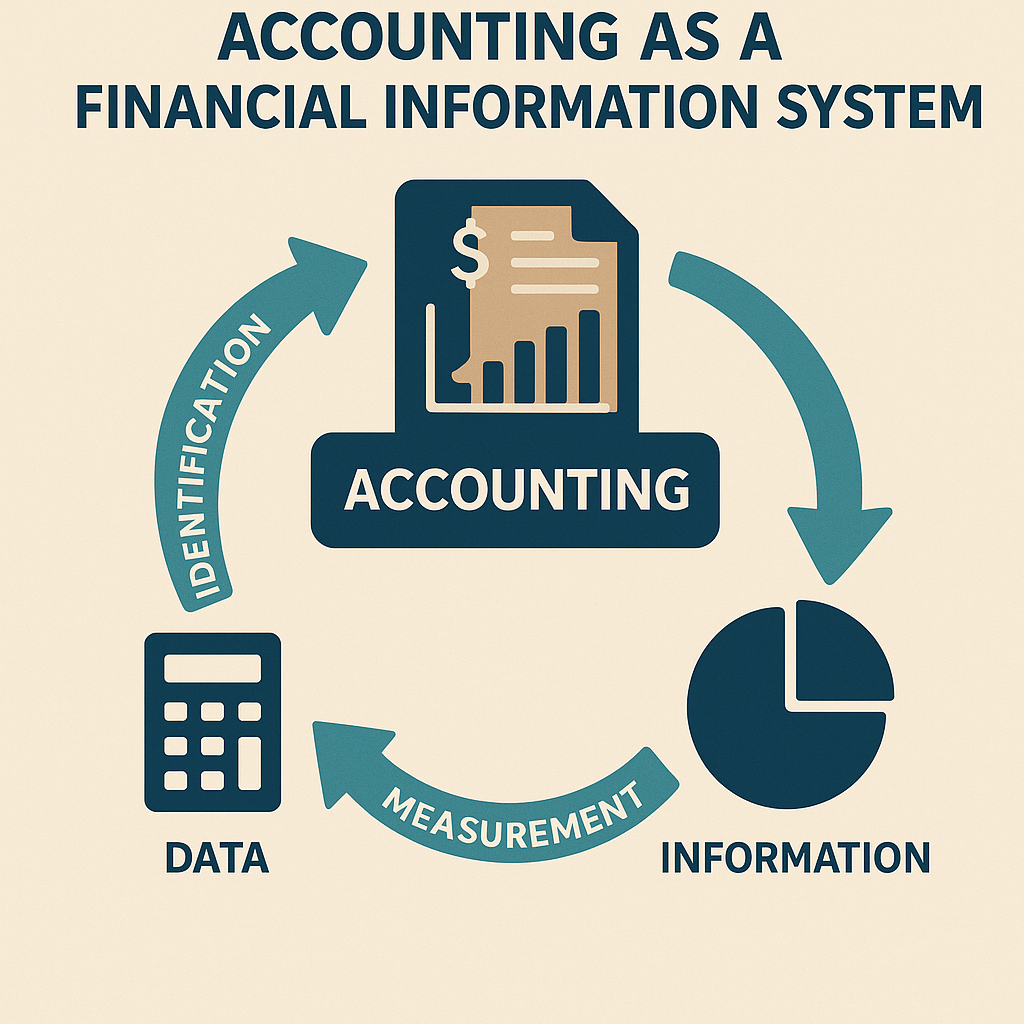

ACCOUNTING AS FINANCIAL INFORMATION SYSTEM:

Objectives of Accounting Objectives of Accounting Systematic Recording of Transactions The fundamental objective of accounting is the systematic and chronological recording of financial transactions through proper book-keeping. These recorded entries are further classified and summarized logically to prepare financial statements and aid in analysis and interpretation. Ascertainment of Results Accounting helps determine the financial outcome […]

ACCOUNTING AS FINANCIAL INFORMATION SYSTEM: Read More »