Infrastructure as an Asset Class: Investing in the Foundations of India’s Future

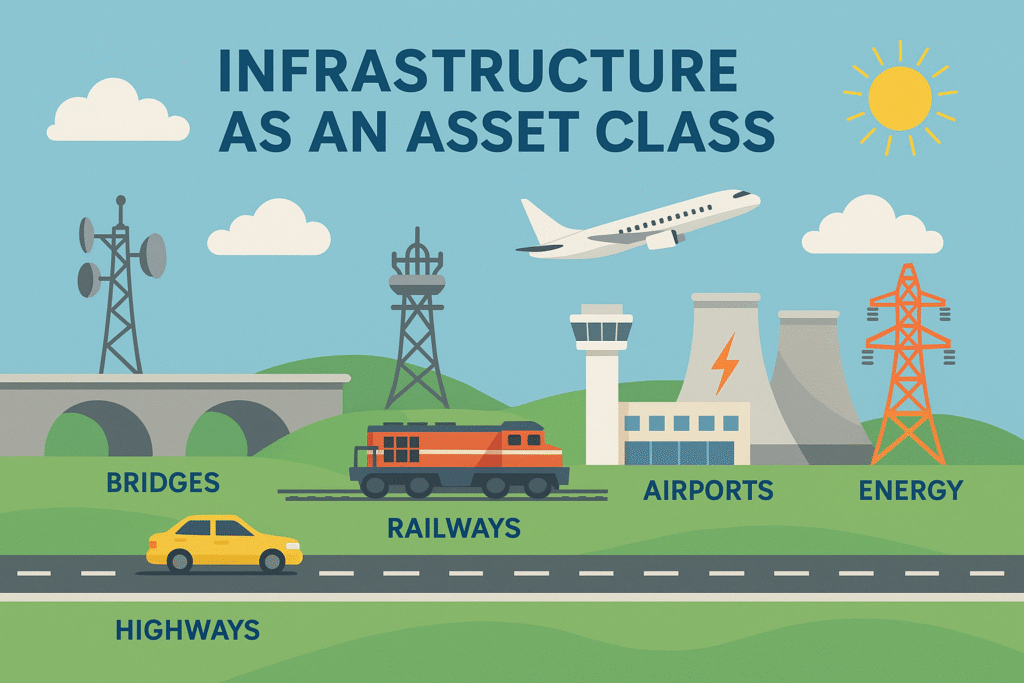

When we think of investing, our minds often jump to stocks, mutual funds, or gold. But there’s a lesser-known and often underappreciated category: infrastructure. Infrastructure assets include long-term physical systems and public utilities such as: Roads, highways, bridges Airports, railways, metros Power plants (thermal, hydro, solar) Ports, logistics hubs, SEZs Telecom towers, fiber networks Water […]

Infrastructure as an Asset Class: Investing in the Foundations of India’s Future Read More »