Finance Essentials

Leverage in Financial Analysis Leverage in Financial Analysis Leverage in financial analysis refers to the effect of a change in one financial variable (such as sales) on another (such as earnings)...

Financial Market Overview Financial Market What is a Financial Market? A financial market is a marketplace where buyers and sellers trade in financial assets such as equities, bonds, derivatives...

Project Appraisal Project Appraisal What is Project Appraisal? Project Appraisal is a comprehensive assessment of the various aspects of a project proposal to determine its feasibility, viability, and...

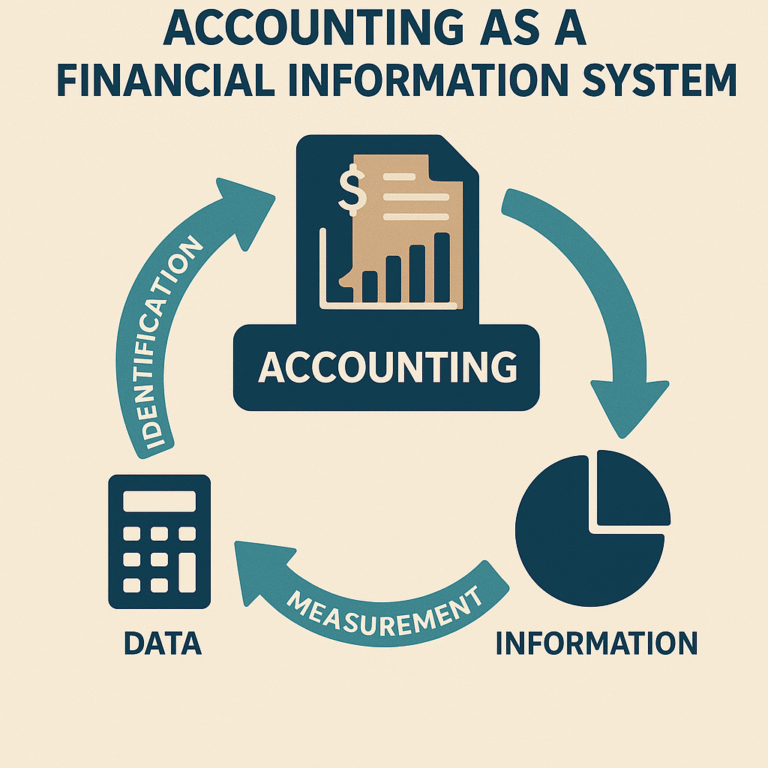

Objectives of Accounting Objectives of Accounting Systematic Recording of Transactions The fundamental objective of accounting is the systematic and chronological recording of financial transactions...

Non-Banking Financial Companies (NBFCs) – Overview Non-Banking Financial Companies (NBFCs) What is an NBFC? A Non-Banking Financial Company (NBFC) is a company registered under the Companies...

Priority Sector Lending (PSL) – RBI Guidelines Priority Sector Lending (PSL) – RBI Guidelines Objective Priority Sector Lending (PSL) aims to ensure that adequate institutional credit reaches...

Working Capital Finance Working Capital Finance Definition Working Capital Finance refers to funding provided to businesses for managing their day-to-day operational expenses such as payment of wages...

Housing Loan Guidelines – Construction & Purchase Housing Loan Guidelines: Construction & Purchase of Dwelling Units Permissible Purposes for Home Loans Purchase or construction of a...

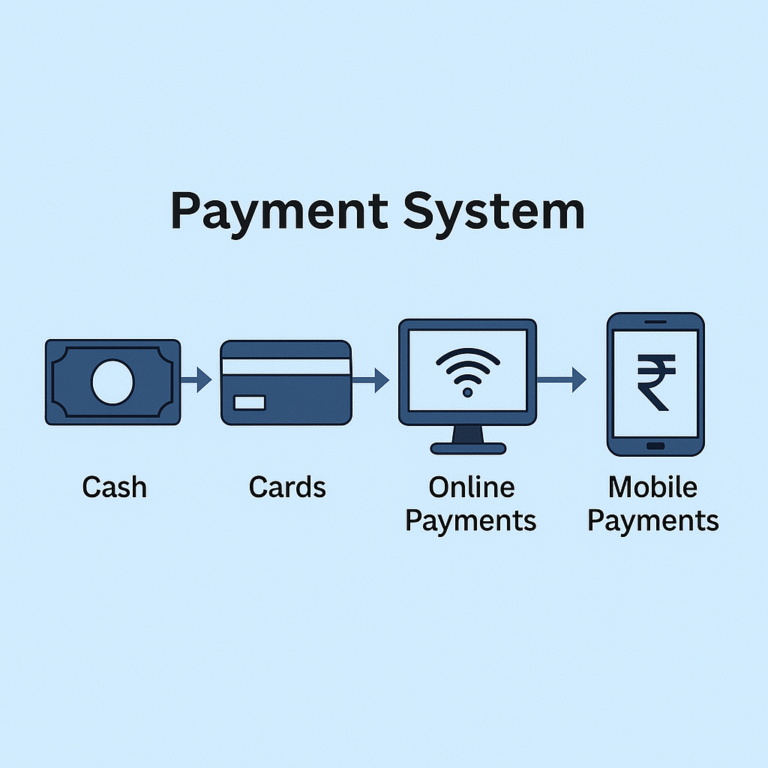

Indian Payment Systems Overview Indian Payment Systems Overview Prepaid Payment Instruments (PPIs) PPIs are instruments that store monetary value and can be used to purchase goods, services, or...