Finance Essentials

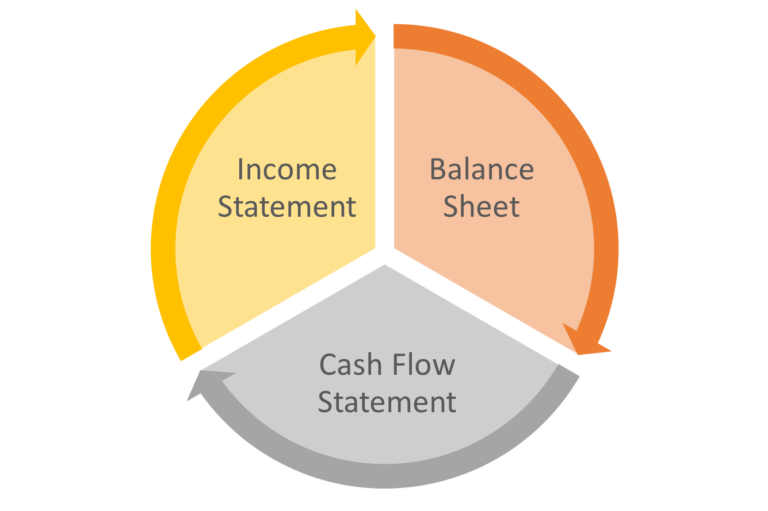

Preparation of Financial Statements Preparation of Financial Statements Financial statements are official records that summarize a company’s business activities and financial performance. These...

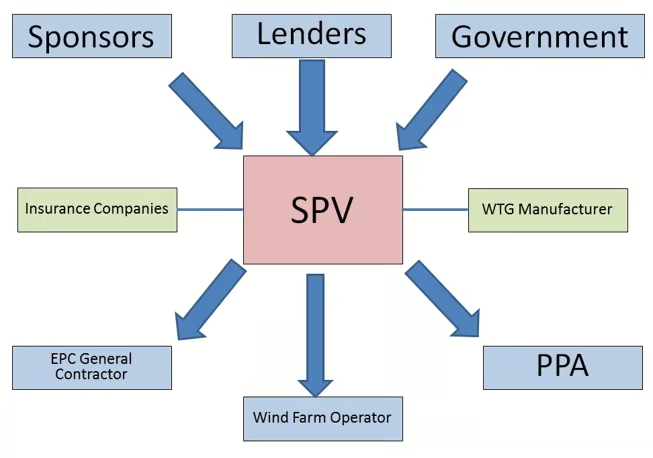

Project Finance Explained Project Finance Definition: Project finance is a long-term financing structure used to fund large-scale infrastructure or industrial projects, where lenders primarily rely on...

RBI Credit Policy also known as loan policy of the bank is instrumental in determining the money supply, the economy’s credit cost, and other national monetary matters. This credit policy is...

Credit Rating Credit Rating Credit Rating is an independent, unbiased evaluation of the creditworthiness of a borrower or an issuer of debt instruments. It reflects the ability of a borrower to repay...

Trade Receivables Discounting System (TReDS) Trade Receivables Discounting System (TReDS) TReDS is an electronic platform for online discounting of bills of MSMEs for supplies to large corporates. It...

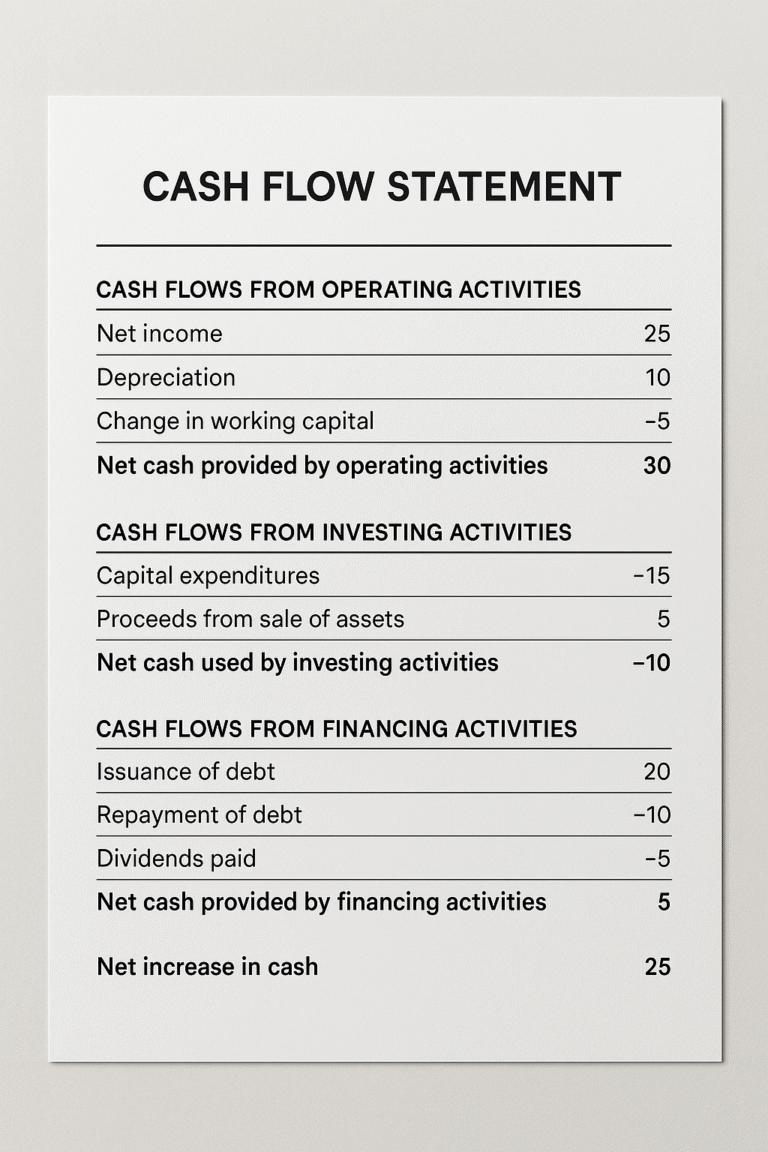

Cash Flow Statement Cash Flow Statement A Cash Flow Statement is a financial report that provides a summary of the cash and cash equivalents entering and leaving a company during a specific period. It...

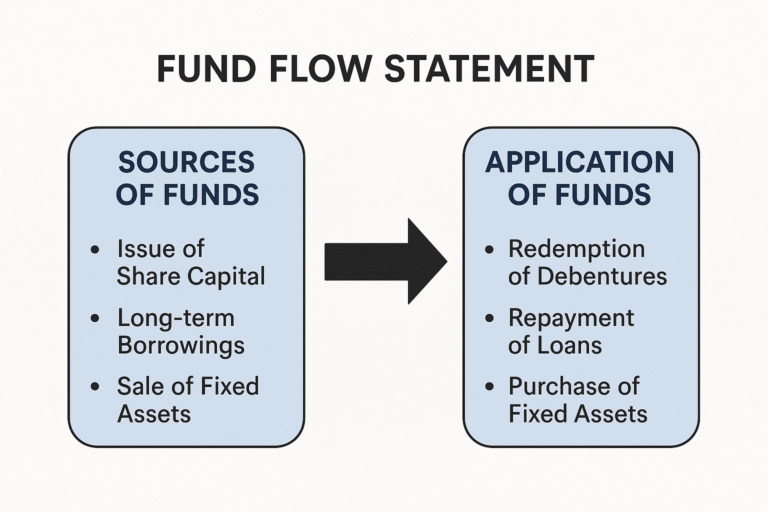

The Ultimate Guide to Fund Flow Statement A Fund Flow Statement is a vital financial tool that helps decode how a business sources and utilizes its funds over a period. While the profit and loss...

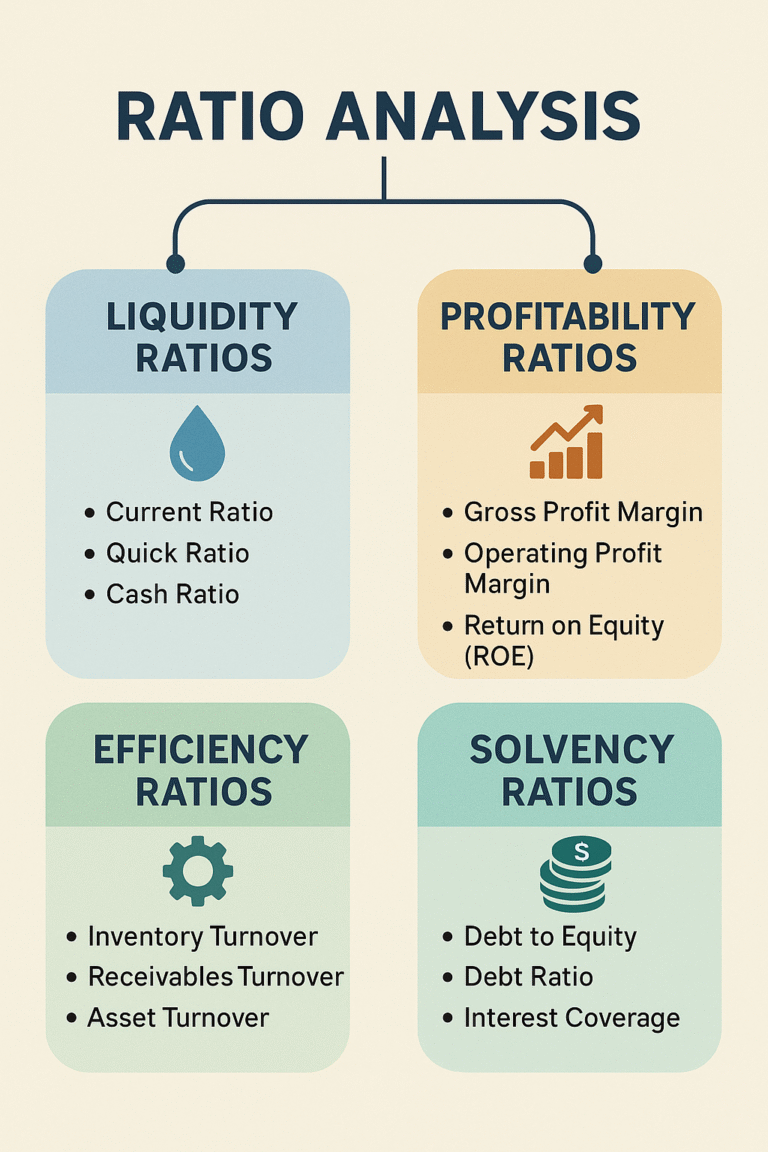

Ratio Analysis in Financial Management Ratio Analysis in Financial Management Ratio Analysis is a quantitative technique used to assess a company’s financial performance by analyzing data from its...

Ratio Analysis: A Complete Guide for Investors Ratio Analysis is the cornerstone of financial statement interpretation. Whether you’re a retail investor, financial analyst, or business owner...