Preparation of Financial Statements

Financial statements are official records that summarize a company's business activities and financial performance. These include statements that reflect the profitability, liquidity, and solvency of a business.

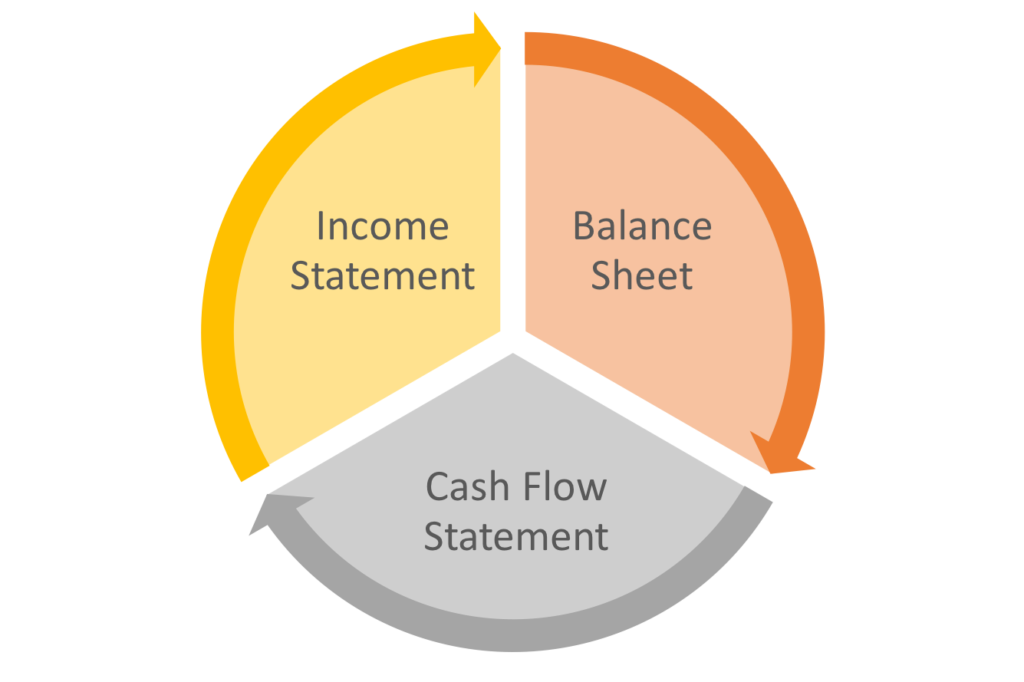

Primary Financial Statements

- Trading Account: Shows gross profit/loss by comparing sales and cost of goods sold.

- Profit & Loss Account: Reflects net profit/loss after considering all incomes and expenses.

- Balance Sheet: Summarizes the assets, liabilities, and equity of a company at a specific date.

- Cash Flow Statement: Displays cash inflows and outflows under operating, investing, and financing activities.

Steps in Preparing Financial Statements

- Record transactions in journal and post them to ledger accounts.

- Prepare a trial balance to verify arithmetic accuracy.

- Pass necessary adjustments like depreciation, accruals, provisions, etc.

- Prepare trading and profit & loss account to calculate gross and net profit.

- Draw up the balance sheet from the final balances after adjustments.

- Prepare the cash flow statement (optional for small businesses).

- Add notes to accounts for disclosures and explanations.

Objectives of Financial Statements

- To provide information about financial performance and position.

- To assist stakeholders in decision-making.

- To help assess a business’s profitability, solvency, and liquidity.

- To ensure statutory and legal compliance with regulations and standards.

Users of Financial Statements

- Management (for decision-making and performance analysis)

- Investors and shareholders (to evaluate return and risk)

- Creditors and banks (to assess repayment capacity)

- Government authorities (for taxation and regulation)

- Employees (to understand job security and performance bonuses)

Note: Financial statements must adhere to applicable accounting principles such as GAAP, Ind AS, or IFRS, depending on the entity and jurisdiction.

Example: A business with ₹50 lakhs in revenue and ₹30 lakhs in expenses would report a net profit of ₹20 lakhs in its Profit & Loss account, and show current assets like cash and inventory in the Balance Sheet.

Final Tip:

Always cross-check your financial statements with supporting documents and audit trails to ensure completeness and accuracy.