The Ultimate Guide to Fund Flow Statement

A Fund Flow Statement is a vital financial tool that helps decode how a business sources and utilizes its funds over a period. While the profit and loss statement tells us whether a company is making money, the fund flow statement tells us what the company is doing with that money. For investors, analysts, and business owners, this statement serves as a financial X-ray of long-term capital movements and operational discipline.

What is a Fund Flow Statement?

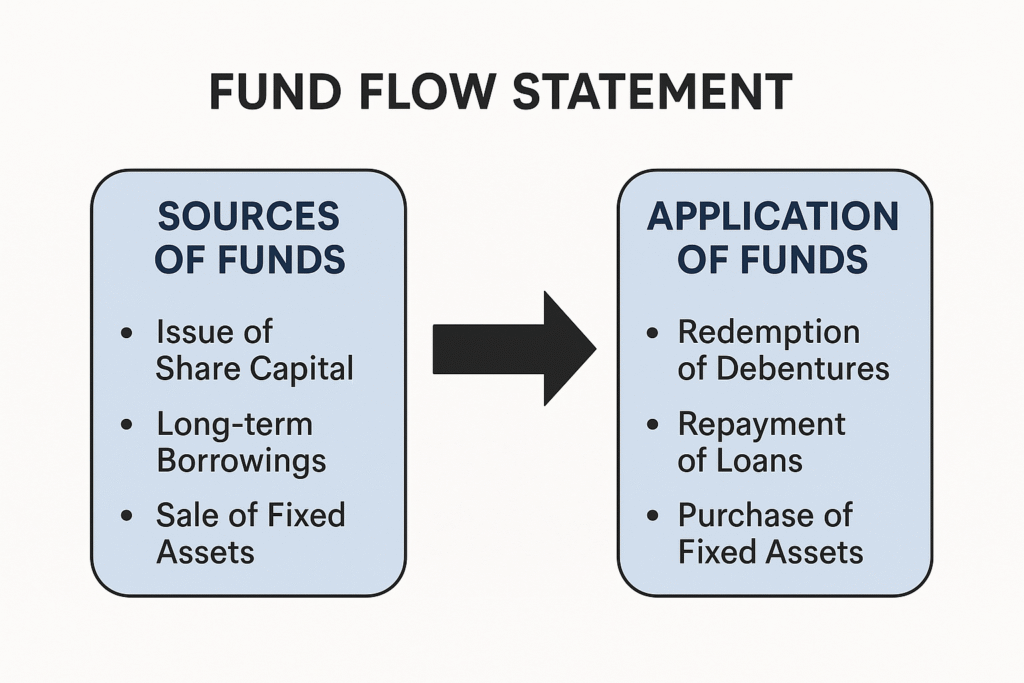

Fund Flow Statement, also called the Statement of Sources and Application of Funds, focuses on movements in working capital. It tracks where the funds came from (sources) and where they were applied (uses). It goes beyond just cash and includes transactions that impact long-term financial planning.

Unlike the Cash Flow Statement which focuses on short-term liquidity and cash equivalents, the Fund Flow Statement is more strategic — examining structural financial health.

Why is it Important?

- Highlights how internal funds are being managed and allocated

- Reveals whether a business is funding growth through operations or debt

- Helps in evaluating long-term financing strategies and reinvestment

- Useful for credit rating, mergers, acquisitions, and investor confidence

Structure of a Fund Flow Statement

Sources of Funds

- Issue of equity or preference shares

- Raising long-term loans or debentures

- Sale of fixed assets or investments

- Operational profits (adjusted for non-cash items)

- Decrease in working capital

Application of Funds

- Purchase of fixed assets or investments

- Repayment of loans or debentures

- Payment of dividends

- Net operating losses (after adjustments)

- Increase in working capital

Understanding Working Capital

Working Capital is the difference between current assets and current liabilities.

Working Capital = Current Assets – Current Liabilities

Changes in working capital are central to the fund flow analysis:

- Increase in Working Capital = Application of Funds

- Decrease in Working Capital = Source of Funds

For instance, if a company increases inventory, it ties up more capital — that’s a use. If it reduces creditors or pays off current liabilities, that’s also a use of funds.

Steps to Prepare a Fund Flow Statement

- Prepare two balance sheets: Beginning and end of the period

- Create a schedule of changes in working capital

- Calculate funds from operations (adjusting net profit for depreciation, amortization, etc.)

- Identify sources and applications of funds

- Compile the Fund Flow Statement by matching both sides

Example: Fund Flow of ABC Ltd.

Let’s assume the following:

- Issued debentures worth ₹1,000 crore

- Earned ₹500 crore from operations (adjusted)

- Sold machinery for ₹100 crore

- Spent ₹800 crore on a new plant

- Repaid loans worth ₹400 crore

- Paid ₹100 crore in dividends

Total Sources: ₹1,600 crore

Total Uses: ₹1,300 crore

Net Increase in Working Capital: ₹300 crore

Fund Flow vs. Cash Flow

| Fund Flow Statement | Cash Flow Statement |

|---|---|

| Focuses on changes in working capital | Focuses on cash inflow and outflow |

| Includes non-cash items like depreciation | Excludes non-cash items |

| Best for long-term financial planning | Best for short-term liquidity assessment |

When Should You Use a Fund Flow Statement?

- To evaluate a company’s long-term financing and investment decisions

- During mergers, acquisitions, or restructuring

- When reviewing corporate debt capacity or creditworthiness

- To analyze whether profit is being reinvested or extracted

Limitations

- Doesn’t track cash position or liquidity

- Cannot replace the need for a cash flow statement

- Relies heavily on the accuracy of balance sheet items

- Not very useful for startups or companies with erratic cash flows

Final Thoughts

While it might not get the same spotlight as the income or cash flow statement, the Fund Flow Statement is a powerful indicator of financial integrity. It gives investors, analysts, and internal decision-makers a detailed picture of how efficiently a company is managing its resources.

For those who want to go beyond surface-level earnings and truly understand how a business builds and sustains growth — mastering the Fund Flow Statement is a must.

Looking to learn more? Explore our guides on Cash Flow vs Fund Flow and Working Capital Analysis. Or better — subscribe to the Smart Niveshak newsletter and receive weekly insights straight to your inbox.