Objectives of Accounting

Systematic Recording of Transactions

The fundamental objective of accounting is the systematic and chronological recording of financial transactions through proper book-keeping. These recorded entries are further classified and summarized logically to prepare financial statements and aid in analysis and interpretation.

Ascertainment of Results

Accounting helps determine the financial outcome of business operations over a specific period. By preparing a Profit and Loss Account, businesses can assess whether they have earned a profit (when revenues exceed expenses) or incurred a loss (when expenses exceed revenues).

Determining Financial Position

Apart from knowing operational results, business owners are also interested in knowing the financial position on a specific date—what they own (assets) and what they owe (liabilities). This is done through the preparation of a Balance Sheet, which provides a snapshot of the business’s financial health.

Providing Information for Decision-Making

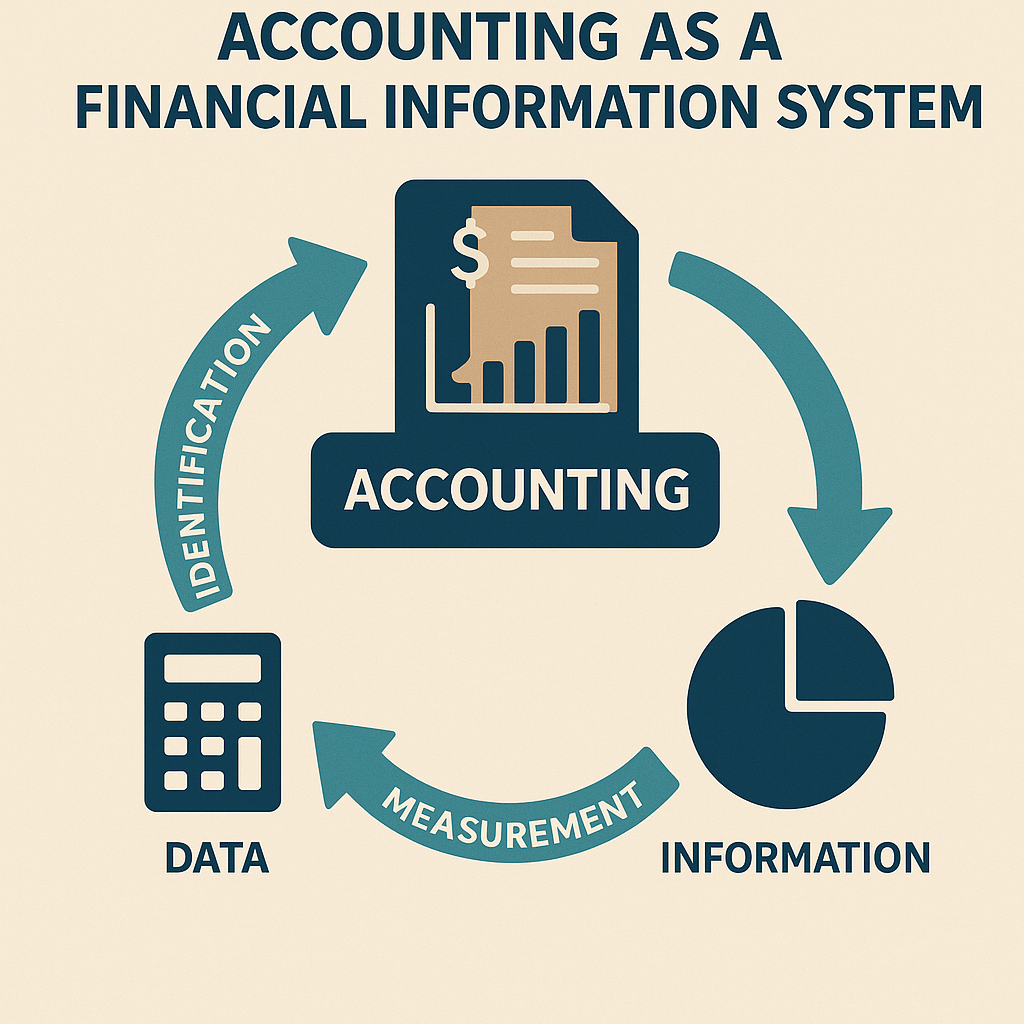

Accounting acts as the language of business. It provides reliable and relevant financial data to internal and external users—such as management, investors, creditors, and regulators—to make rational and informed decisions.

Through accounting statements like the Balance Sheet and Cash Flow Statement, stakeholders can evaluate a company’s ability to meet its short-term obligations (liquidity) and its long-term commitments (solvency).